Cost of Using a Financial Adviser vs. Doing It Yourself

Disclaimer: This article provides general information and does not constitute financial advice. You should speak to a financial adviser about your specific situation. Frank Wealth adviser costs are outlined here.

When it comes to managing your money, you've got two main choices: hire a professional financial adviser or take the "Do It Yourself" (DIY) route. Both paths can lead to success, but they come with very different costs and responsibilities. Let's break down what you're really paying for.

What Does a Financial Adviser Cost?

Think of a financial adviser as a financial personal trainer. You're paying for their expertise, a personalised plan, and ongoing support to keep you on track. The fees generally fall into a few categories.

One-Off Planning Fee: This is for creating a comprehensive financial plan. It's a bit like paying an architect for a set of house blueprints. You can expect this to be anywhere from $1,500 to $5,000+, depending on how complex your situation is.

Ongoing Advice Fee: This is the most common model if you want an adviser to manage your investments and meet with you regularly. It's typically charged as a percentage of the money they look after for you. This can range from 0.5% to 1.5% per year.

Hourly Rate: Some advisers charge for their time, just like a lawyer or accountant. This is less common for investment management but can be used for specific advice. Rates often sit between $200 and $400 per hour.

It's also crucial to know how your adviser is paid. Some are "fee-only," meaning you're their only source of income. Others might earn commissions from the investment or insurance products they recommend. Always ask for a clear breakdown of all fees.

What Does DIY Investing Cost?

Going DIY means you're the fund manager, researcher, and planner all in one. While you save on advice fees, you still pay costs to buy, sell, and hold your investments.

Platform & Brokerage Fees: These are the costs to use an online platform like Sharesies, Hatch, or ASB Securities.

Transaction Fees: You pay a fee every time you buy or sell. This could be a small percentage (e.g., 1.9%) or a flat fee (e.g., $3 to $25 per trade).

Foreign Exchange Fees: If you buy overseas shares (like in the US), you'll be charged a fee to convert your NZ dollars. This is usually a percentage, often between 0.35% and 1.0%.

Fund Management Fees: This is a key cost that DIY investors often overlook. If you buy into an Exchange Traded Fund (ETF) or a Managed Fund, the company that runs the fund charges its own annual fee. This is taken directly out of the fund's returns and can range from as low as 0.1% to over 2% per year.

Comparing the "True Cost"

The debate isn't just about fees. The "true cost" includes your time, your stress, and the risk of making a mistake.

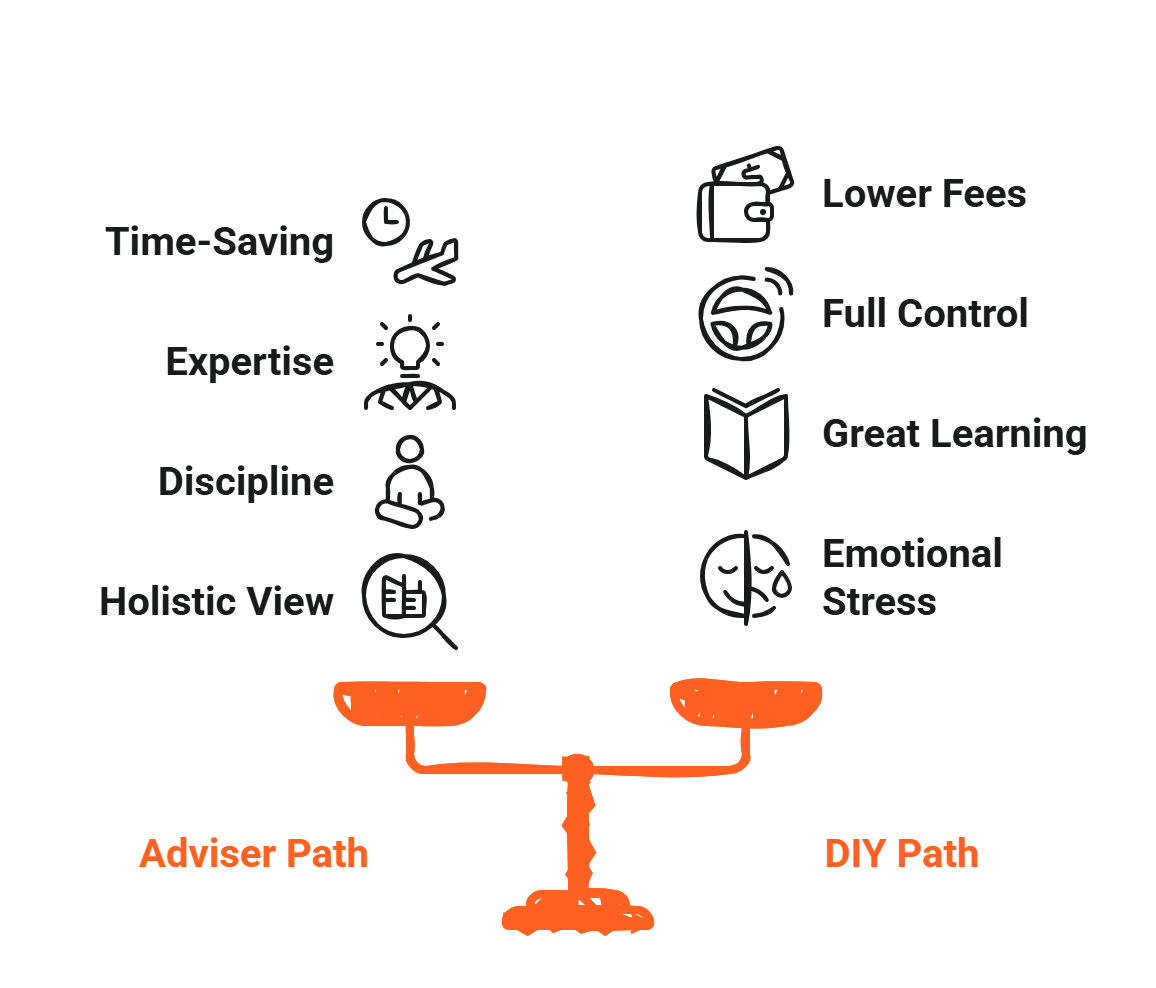

The Adviser Path

Pros:

Expertise: You get a professional strategy tailored to your goals.

Time-Saving: They do all the research, admin, and rebalancing.

Discipline: This is a big one. An adviser acts as a "behavioural coach" to stop you from making emotional decisions, like panic-selling when the market drops.

Holistic View: They can help with your whole financial life, from KiwiSaver and insurance to retirement and estate planning.

Cons:

The Obvious Cost: You are paying a fee for the service, which will reduce your net returns.

The DIY Path

Pros:

Lower Fees: Your direct costs are often lower, which can have a big impact over time.

Full Control: You decide exactly what to buy and when to sell.

Great Learning: You'll learn a huge amount about markets and investing.

Cons:

Huge Time Cost: Serious DIY investing isn't a 10-minute-a-week job. It requires hours of research and monitoring.

The "Knowledge Gap": It's easy to make mistakes. You need to understand complex tax rules (like the FIF regime for overseas investments), diversification, and risk.

Emotional Stress: It's tough to watch your own money go up and down. Without a buffer, many DIY investors buy high (when things feel safe) and sell low (when they panic).

The Bottom Line

Choosing between an adviser and DIY comes down to a simple trade-off: money vs. time and expertise.

Using a financial adviser is about paying for a service that provides expertise, saves you time, and helps manage your emotions, with the goal of getting you a better net outcome in the long run.

Going DIY is about saving on fees by investing your own time and energy, but you take on all the responsibility and risk yourself.

There is no single right answer, but the best one for you depends on your confidence, your time, and, most importantly, your willingness to stay the course.