The Different Types of Financial Advisers in New Zealand (and Which One is Right for You)

While Frank Wealth is a financial advice firm, this guide is designed to provide you with impartial, essential information about the different types of financial advisers in New Zealand. Our goal is to empower you with knowledge, ensuring you get the best guidance, no matter who you choose.

Navigating your finances can feel a bit like trying to solve a puzzle with a thousand pieces. Should you save more? Invest? Get insurance? That's where a financial adviser comes in. Someone to help you put those pieces together.

But did you know there isn't just one type of financial adviser? Just like doctors specialise in different areas of health, financial advisers often focus on different aspects of your money. Understanding these differences can help you pick the right professional to guide you.

Let's break down the main types of financial advisers you'll find in New Zealand.

1. The Mortgage Adviser (or Mortgage Broker)

What they do: These advisers are specialists in home loans. They work with various lenders (banks and non-bank lenders) to find you the best mortgage deal for buying a home, refinancing, or investing in property. They'll help you understand interest rates, loan structures, and application processes.

When you need them: If you're buying your first home, looking to switch your mortgage to a better rate, or want to use your home equity, a mortgage adviser is your go-to person.

Think of them as: Your personal home loan hunter and guide.

2. The Insurance Adviser

What they do: Life throws curveballs, and insurance is there to protect you financially when they hit. An insurance adviser helps you identify potential risks (like illness, accident, or even death) and recommends the right types of insurance policies to protect yourself, your family, and your income. This could include life insurance, income protection, critical illness cover, and health insurance.

When you need them: If you have dependents, a mortgage, or want peace of mind knowing you're financially covered if something unexpected happens.

Think of them as: Your financial safety net designer.

3. The Investment Adviser (or Wealth Adviser)

What they do: This is where your money can start working harder for you! An investment adviser helps you set financial goals (like saving for retirement, a child's education, or a future big purchase) and then creates a personalised investment strategy. They'll explain different investment options like KiwiSaver, shares, managed funds, and property, helping you understand the risks and potential returns.

When you need them: If you have surplus income you want to invest, are planning for retirement, want to grow your wealth over the long term, or need help with your KiwiSaver choices.

Think of them as: Your wealth growth strategist.

4. The Financial Planner (or Holistic Financial Adviser)

What they do: A financial planner takes a broader, more comprehensive view of your entire financial picture. They often combine elements of investment, insurance, and even budgeting advice. They'll help you define your short-term and long-term financial goals, create a detailed plan to achieve them, and review it regularly. They look at everything. Your income, expenses, debts, assets, and future aspirations.

When you need them: If you want a complete financial roadmap, have multiple financial goals, or simply feel overwhelmed by your overall financial situation and need a clear direction.

Think of them as: Your personal financial architect, building your entire financial blueprint.

5. The Budgeting Adviser (or Financial Mentor)

What they do: While not always called "advisers" in the same way, budgeting services and financial mentors play a crucial role. They help individuals and families get a handle on their daily money management. They teach you how to track income and expenses, create a realistic budget, manage debt, and develop healthy spending habits.

When you need them: If you're struggling to make ends meet, want to get out of debt, or simply want to feel more in control of your everyday spending.

Think of them as: Your money management coach.

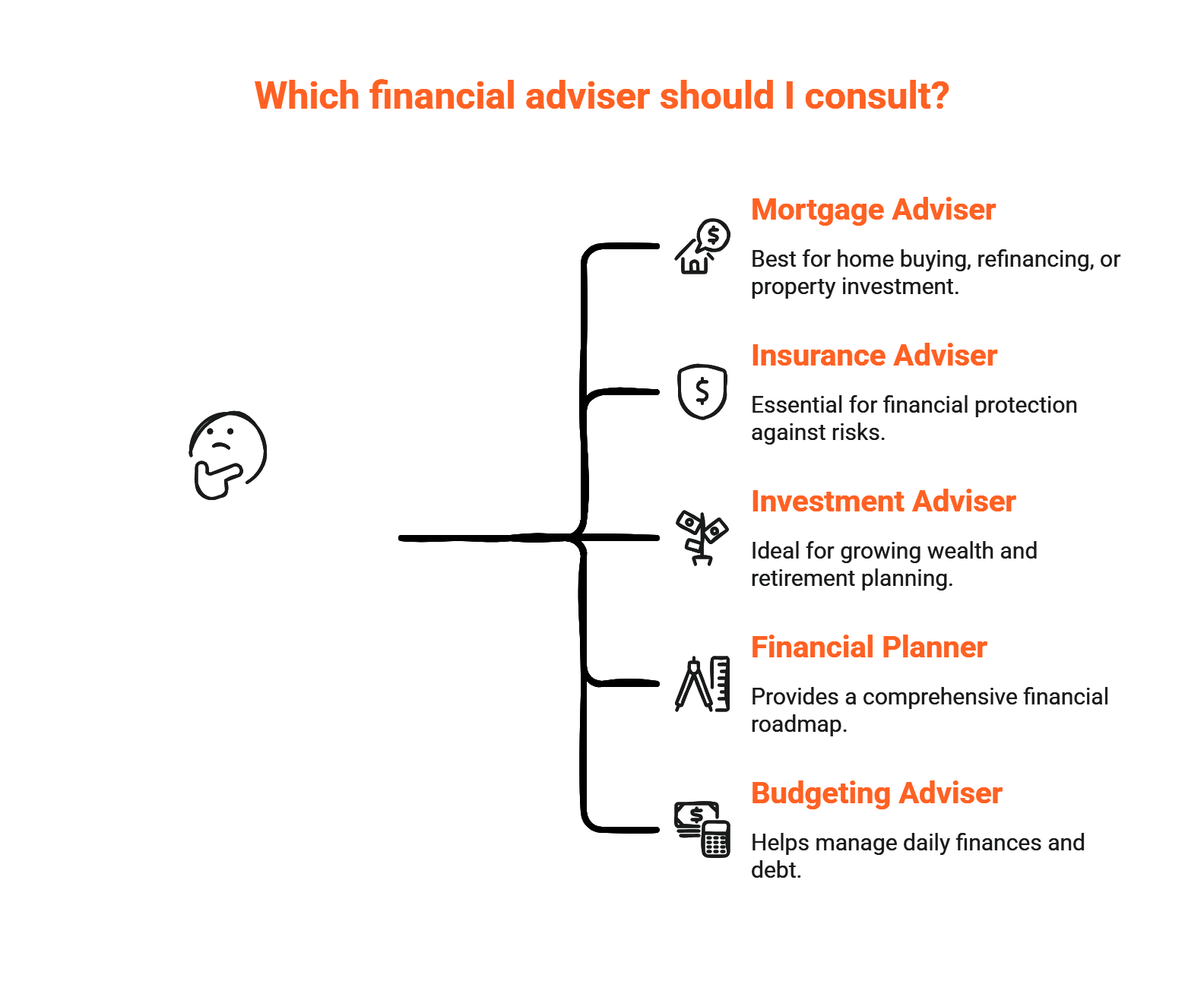

Which One is Right for You?

The "right" adviser depends entirely on your current situation and what you're hoping to achieve.

Starting out with a home loan? A Mortgage Adviser is likely your first stop.

Worried about protecting your family's future? An Insurance Adviser can help.

Have some savings and want them to grow? An Investment Adviser is key.

Feeling overwhelmed and want a full financial strategy? A Financial Planner is probably what you need.

Struggling with day-to-day spending and debt? A Budgeting Adviser can provide practical support.

It's also common to work with different advisers at different stages of your life, or even simultaneously for different needs. Many advisers also have networks and can refer you to other specialists if your needs extend beyond their primary focus.

The most important step is to start the conversation. Don't hesitate to reach out to an adviser, discuss your situation, and see how they can help you build a more secure financial future.