How much does a financial adviser cost?

Disclaimer: This article provides general information and does not constitute financial advice. You should speak to a financial adviser about your specific situation. Frank Wealth adviser costs are outlined here.

It’s one of the most common and important questions we hear: "How much is this all going to cost?"

And the short, honest answer is, it depends.

Getting your finances sorted can feel overwhelming. You’re juggling your mortgage, KiwiSaver, insurance, maybe some investments, all while trying to plan for retirement. Hiring a professional to help you build a clear path makes sense, but how much does it all cost?

The cost of financial advice isn't standardised. In New Zealand, advisers are paid in a few different ways, and the right model for you depends on the type of help you need.

Let’s break down the common fee models so you can understand what you're paying for. (All financial advisers in New Zealand must follow a Code of Conduct, which means they must put your interests first, regardless of how they are paid).

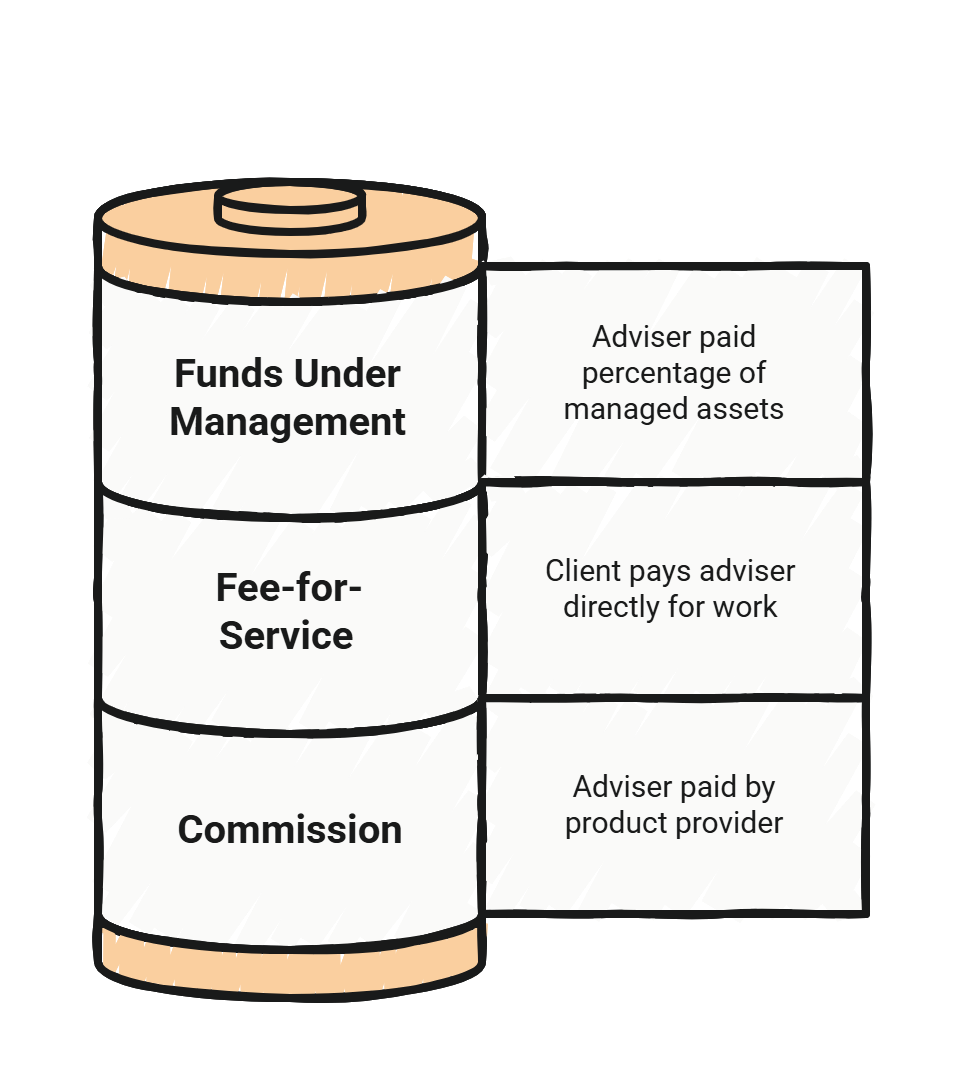

The Main Ways Advisers Are Paid

1. Commission

This model is most common for services like insurance, mortgages, or some KiwiSaver products.

How it works: The adviser receives a payment (a commission) from the insurance or bank (mortgage) whose product you sign up for.

What it costs you: This model often feels free to you, since you don't receive a separate bill from the adviser. The cost is built into the price of the product you buy (like the insurance premium).

Best for: People who need help setting up specific products, like getting their mortgage or life insurance sorted.

2. Fee-for-Service (Paying Directly)

You pay the adviser directly for their work, just like you would pay an accountant or a lawyer.

Fixed Fee: You agree on a set price for a specific piece of work. For example, $X for a comprehensive retirement plan or $Y for a full review of your investment portfolio. This is great for knowing the exact cost upfront.

Hourly Rate: You pay for the adviser's time. This is less common for full financial plans but can be perfect if you just need a "financial check-up" or have a few specific questions you want answered.

Best for: One-off projects like building a full financial plan, getting a second opinion, or specific retirement advice.

3. Funds Under Management (FUM) Fee

This model is standard for ongoing investment management.

How it works: The adviser charges a percentage of the money they are managing for you. For example, if they manage a $400,000 investment portfolio with an annual fee of 1% your annual fee would be $4,000. This is typically charged monthly or quarterly, directly from the investment account.

What it costs you: A small, ongoing percentage of your portfolio.

Best for: People who want a professional to build and manage their investments over the long term. This fee covers ongoing monitoring, rebalancing, and regular reviews to keep you on track. The adviser’s fee grows as your wealth grows, which aligns your interests.

It's Not Just "Cost", It's "Value"

Asking about cost is smart. But the more important question is "What value am I getting for that fee?".

A cheap adviser who gives bad advice is expensive. A great adviser who charges a fair fee can be the best investment you ever make.

The real value of advice isn't just about picking investments. It's about:

Building a Strategy: Creating a realistic, step-by-step plan to get you from where you are to where you want to be (like retiring comfortably or buying a first home).

Saving You Time: The adviser handles the complexity so you don't have to.

Behavioural Coaching: This is the big one. A good adviser acts as a barrier between you and bad decisions. For example, a good investment adviser will help you avoid panic-selling when the market drops or chasing a "hot stock" that's too risky. This behavioural coaching is often worth more than the fee itself.

Expertise: You're paying for specialist knowledge of tax, products, and strategy that takes years to develop.

What You Should Ask

Don't be shy about money. A good, professional adviser will be 100% transparent about their fees.

When you talk to any adviser (including me), you should feel comfortable asking:

"How do you get paid?" (Are you paid by commissions, fees, or a percentage?)

"Can you give me a clear breakdown of all the costs I will pay?"

"What services are included for that fee?" (Will we meet once a year? Do you manage everything? Can I call you with questions?)

"Are you a Financial Advice Provider (FAP) or working for one?" (In NZ, all advice must come from, or through, a licensed FAP).

The right adviser for you will be happy to answer these questions clearly. Finding someone you trust, who explains things in a way you understand, is just as important as the fee structure itself.