How independent is your financial adviser? (the answer might surprise you)

While Frank Wealth is a financial advice firm, this guide is designed to provide you with impartial, essential information about how financial advice really works in New Zealand. Our goal is to empower you with knowledge, ensuring you get the best guidance, no matter who you choose.

When you seek financial advice, you're looking for one thing above all. Guidance that is 100% in your best interest. We often use the word "independent" to describe this. We picture an adviser who sits on our side of the table, free from any outside influence, helping us make the right decision.

But how "independent" is the average adviser in New Zealand? And more importantly, is that even the right question to be asking?

The "Independence" Myth vs. Reality

In a perfect world, an "independent" adviser would be someone you pay directly (maybe via a fee) who has absolutely no links to any bank, insurance company, or investment provider. Their advice would be totally impartial because they don't get a commission or kickback for recommending one product over another.

This "fee-only" model certainly exists, and it's a great, transparent way of working.

However, many New Zealanders get their advice from advisers who are paid differently. They might work for a bank or be paid a commission by an insurance company whose policy they recommend.

This is where you might think, "Aha! That's not independent!"

And here's the surprise: the regulator's main focus isn't on the word "independent".

Under New Zealand's rules, regulated by the Financial Markets Authority (FMA), the focus is on conduct and disclosure. All licensed financial advisers, no matter how they are paid, have a legal duty to follow the ‘Code of Professional Conduct for Financial Advice Services’.

This Code legally requires all advisers to:

Give priority to your interests.

Act with integrity and treat you fairly.

Disclose any conflicts of interest clearly (like how they get paid).

Explain the scope of their advice (e.g., "I can only advise on Westpac products").

Exercise skill, care, and diligence.

The Real Question: "How Are You Paid?"

Since the label "independent" isn't the golden ticket, you need to become a savvy client. The most powerful question you can ask isn't "Are you independent?" but "How do you get paid?"

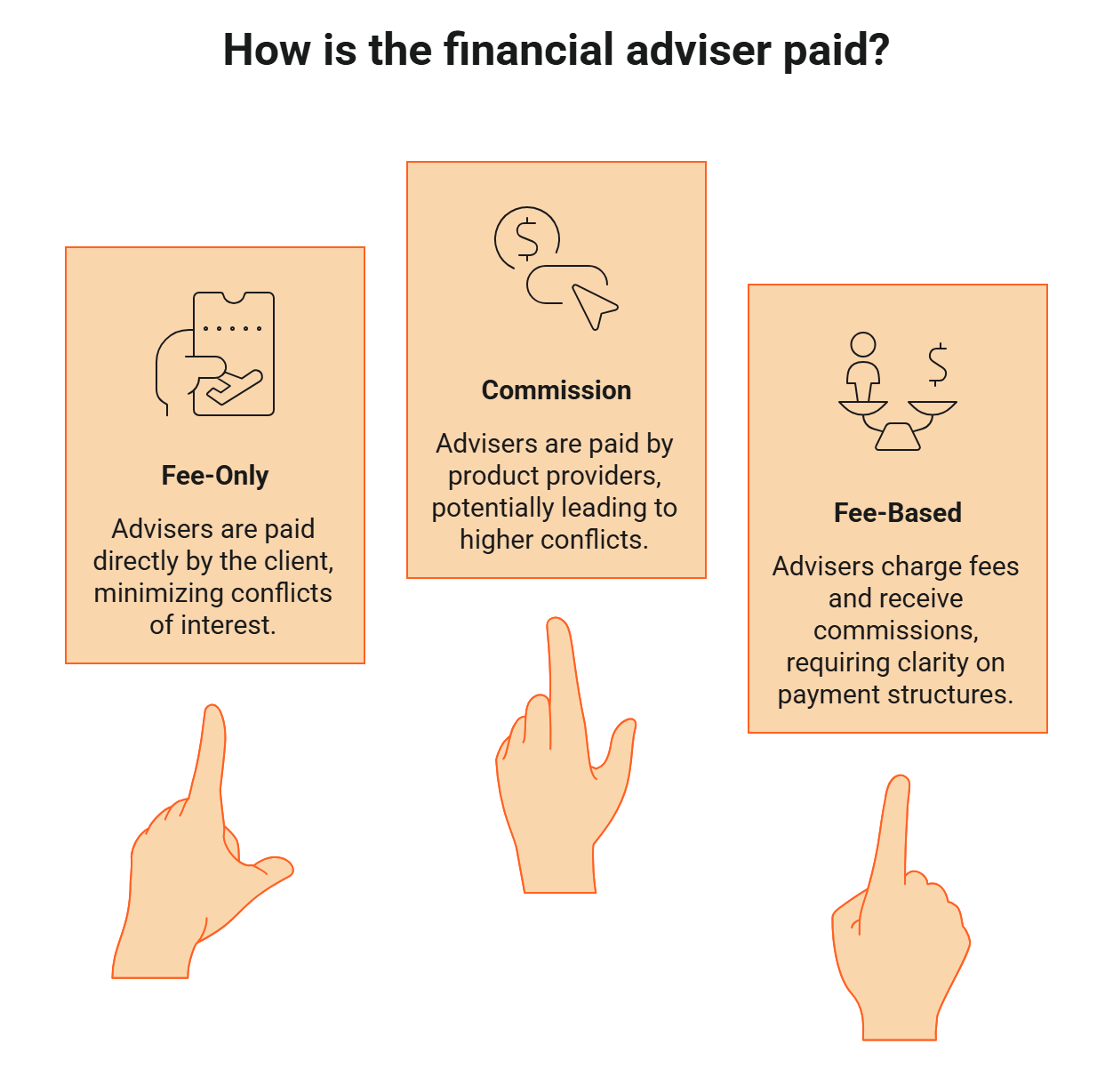

Understanding this cuts right to the heart of the matter and reveals any potential conflicts of interest. Generally, advisers are paid in one of three ways:

Fee-Only: You pay the adviser directly for their time or service. This could be an hourly rate, a fixed fee for a financial plan, or a percentage of the assets they manage for you (This is how Frank Wealth advisers are paid).

Potential Conflict: Very low. Their incentive is to give good advice to keep you as a happy, paying client.

Commission: The adviser is paid a commission from a product provider (like an insurance company or a KiwiSaver fund) when you sign up for their product. You typically don't see a bill for this advice.

Potential Conflict: Higher. The adviser may be tempted to recommend a product that pays them a higher commission, even if it's not the absolute best fit for you.

Fee-Based (or a Mix): The adviser might charge you a fee for a financial plan but also receive commissions on products they recommend (like insurance).

Potential Conflict: A mix. This can be a good model, but you need to be clear on which parts you're paying for and which parts the provider is paying for.

Remember: under the rules, an adviser must tell you how they are paid. They can't hide it.

Forget "Independent". Ask These 3 Questions Instead

Don't get hung up on a word. Instead, go into your meeting armed with these three questions to find out what really matters.

1. How do you get paid? Is it from fees I pay you, commissions from providers, or a mix of both? This is the big one. It tells you exactly where their paycheck comes from.

2. Do you have any limitations on the products or providers you can recommend? This reveals the "scope" of their advice. An adviser at a bank might say, "Yes, I can only advise on our bank's KiwiSaver and investment funds." A mortgage broker might say, "I work with 15 different lenders, but not ANZ or Kiwibank." This is crucial information.

3. How do you manage any conflicts of interest? This is a crucial follow-up to question #1. If they get commissions, they should be able to explain how they still put your interests first. A good answer might sound like, "We compare products from several companies, and our recommendation is based on the quality of the product and your needs, not the commission we receive. We'll show you this comparison."

The Takeaway

The surprise is that you, the client, have more power than you think. The rules are designed to protect you, but they rely on transparency.

Your job isn't to find an adviser with the "independent" label. Your job is to find a licensed adviser you trust, who communicates clearly, and who can answer the three questions above to your satisfaction. That's the real secret to getting advice that's truly in your best interest.